PrimePoint Indicators

Optimize every trade with our premium indicator suite—designed to give you institutional-grade insights at a retail-trader price. Fast to install and easy to customize, our indicators help you spot high-probability setups, manage risk, and stay one step ahead of the curve.

Core Indicators

PrimePoint Traders Trend Trailer

Stay ahead of market turns and ride winning trends like the pros with our Trend Trailer indicator—your real-time guide to trend direction, strength, and intelligent trailing stops.

🔍 Key Features

Adaptive Trend Line

A dynamic moving-average trailer that smooths price action yet reacts swiftly when momentum shifts, helping you distinguish genuine trends from whipsaws.Color-Coded Direction

Instantly see bullish (green) versus bearish (red) trends as the line shifts—no guesswork, just clear visual guidance.Volume-Weighted Smoothing (Optional)

Amplify the trailer’s responsiveness on high-volume bars to lock onto institutional-driven moves, while filtering out noise during quiet sessions.Built-In Trailing Stop Levels

Automatically plot trailing-stop lines at configurable offsets below (long) or above (short) price, so you can lock in profits without manual calculation.Multi-Timeframe Trend Confirmation

Reference a higher-timeframe trailer overlaid on your chart for trend-filtering—trade in the direction of the dominant trend to boost your win-rate.Fully Customizable Inputs

– Trailer Length: Choose how many bars to look back for trend detection (default 21).

– Stop Offset: Set your trailing-stop distance in ATR, percentage, or fixed ticks.

– Volume Sensitivity: Toggle VW-smoothing on/off and adjust its multiplier.

– TF Source: Apply the trailer to close, HL2, or any custom price series.

PrimePoint Traders Volume Weighted Deviation Bands

Dial into true market volatility and volume dynamics with our flagship Deviation Bands indicator—engineered to reveal price extremes and institutional‐grade momentum with surgical precision.

🔍Key Features

Volume-Weighted Moving Average (VWMA) Centerline

Anchors your view of “fair value” by giving each bar’s closing price the weight of its traded volume—so only bars with real market interest shape the trend.Multi-Level Deviation Channels

Three fully customizable bands (1σ, 2σ, 3σ by default) expand and contract around the VWMA to highlight normal trading ranges, mid-strength breakouts, and extreme volatility zones.Clean, No-Fill Overlay

Crisp lines overlay directly on your chart—no distracting color blocks—so you can see exactly where price sits relative to each volatility threshold.Zero Repaint, Real-Time Calculation

Built on Pine v5’s nativeta.vwmaandta.stdev, our bands update bar by bar without future-looking bias, making them rock-solid for live alerts and historical backtests alike.Fully Adjustable Inputs

– Length: Define your look-back period (default 20 bars) for scalping, swing, or position trading.

– Deviation Multipliers: Tune each σ band to match your risk tolerance and the asset’s typical churn.

– Source: Plot bands off close, typical (HLC3), or any custom series.

PrimePoint Traders Sessions

Master the market’s heartbeat by visually mapping the world’s major trading sessions—Asia, London, and New York—directly on your price chart. Never miss the high-volatility windows where real opportunities lie.

🔍 Key Features

Multi-Session Highlighting

Automatically shades and labels the Asia, London, and New York sessions in distinct colors, so you always know which market is in play.Customizable Time & Timezone

Define your own start/end times and select any timezone (Tokyo, London, New York, or your local) to match the exact session windows you trade.Session Start & End Labels

See “Asia Start,” “London End,” or “NY Start” markers on the chart’s very first and last bars of each session—perfect for timing entries and exits.Lightweight Overlay

Designed for minimal footprint: clear, borderless labels and subtle shading keep your chart uncluttered while conveying critical session context.Toggleable Sessions

Turn each region on or off with a click—focus on just London and New York, or isolate Asia, depending on your strategy.Cross-Market Compatibility

Equities, Forex, Crypto or Futures: works seamlessly on any instrument, on any intraday timeframe (1 m through 4 h).Zero Repaint & Real-Time

Pure time-based logic ensures your session highlights and labels update bar by bar without lookahead bias—ideal for live trading and automated alerts.

Professional Indicators

PrimePoint Traders Momentum Matrix

Unlock the next level of market timing with our Momentum Matrix, a powerful volume-weighted oscillator engineered to reveal the true strength—and exhaustion—behind every price move.

🔍Key Features

Volume-Weighted Momentum

Every bar’s momentum ((close – closeₙ)) is amplified by its trading volume, so only high-participation moves carry extra weight—filtering out noise from thin, low-liquidity periods.Adaptive Smoothing

A built-in RMA smoother lets you dial in the perfect balance between responsiveness and clarity, highlighting real shifts without whipsawing.Statistical Threshold Bands

Dynamic ±σ bands surround your oscillator, automatically expanding and contracting with prevailing volatility. Spot over-extended momentum when the histogram breaches these data-driven boundaries.Intuitive Histogram Display

Positive momentum bars are colored green, negative bars red—so you can instantly see bullish versus bearish thrust.Zero-Center Anchor

A crisp zero line keeps you grounded: crosses above signal emerging bullish pressure; dips below warn of growing bearish momentum.Fully Customizable Inputs

• Momentum Length: Choose how far back to compare (e.g. 14 bars).

• Volume Multiplier: Control how aggressively volume amplifies momentum.

• Smoothing Period: Tune the RMA to taste—from razor-sharp signals to ultra-smooth trend profiles.

• Threshold Multiplier: Set your “over-momentum” sensitivity (1×σ, 1.5×σ, 2×σ, etc.).

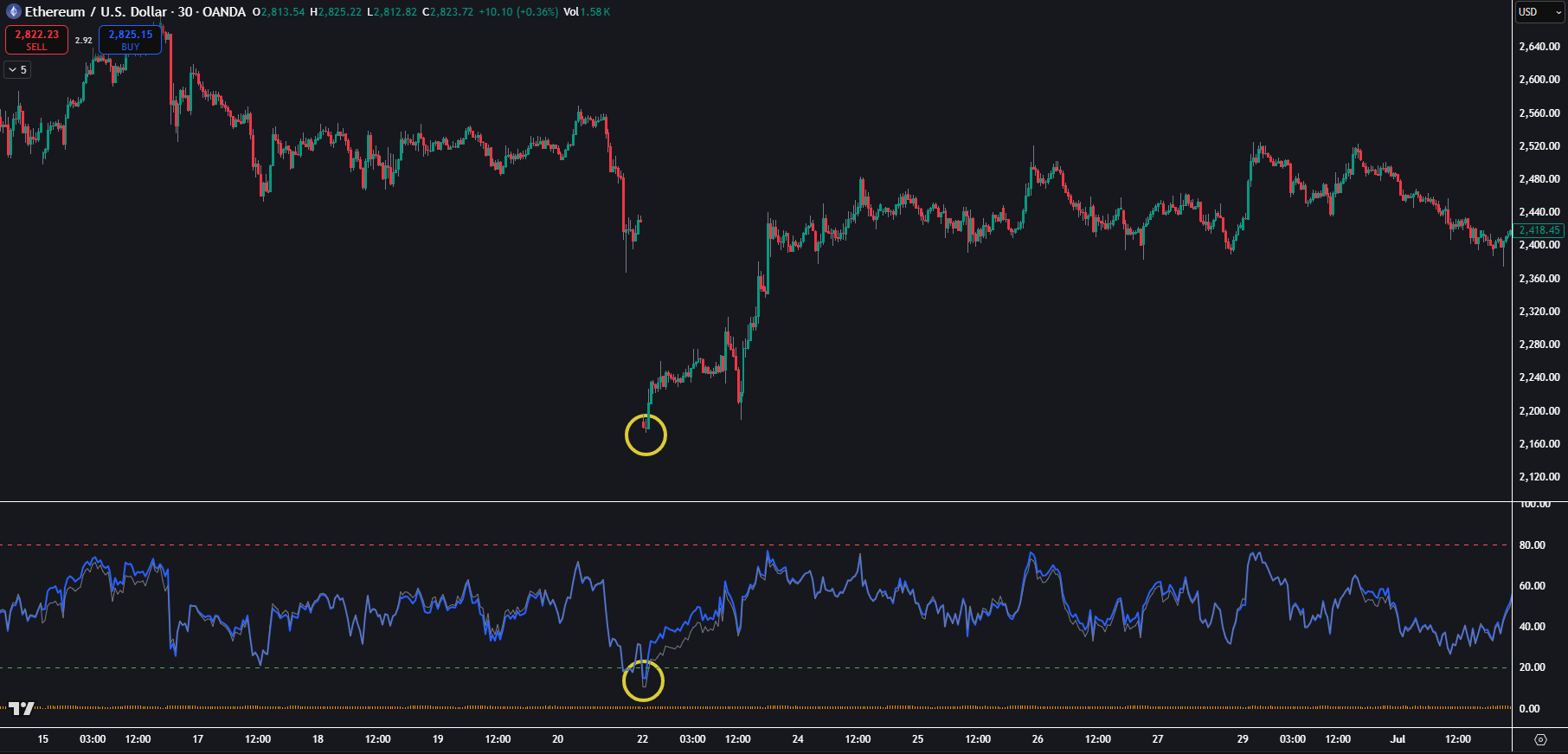

PrimePoint Traders Top and Bottom Finder

Pinpoint precise overbought and oversold extremes with surgical accuracy — our Top & Bottom Finder uses multi-level RSI zones to flag the most reliable reversal points in real time.

🔍 Key Features

Dual Overbought & Oversold Zones

Two configurable upper bands (e.g. 75 & 85) and two lower bands (e.g. 25 & 15) let you distinguish routine pullbacks from true exhaustion events.Volume-Weighted Option

Amplify RSI sensitivity during heavy trading sessions so that only high-participation moves trigger top/bottom signals—filtering out low-volume noise.Clear Buy/Sell Signals

Automatic “Buy” labels appear when RSI dips into your chosen oversold zone; “Sell” labels light up on overbought crosses—so you never miss a prime entry or exit.Clean, No-Repaint Logic

Built on native Pine v5 (ta.rsi,ta.rma), it updates bar-by-bar with zero look-ahead bias—perfect for live alerts and backtesting alike.Overlay or Separate Pane

Plot the RSI panel beneath your chart or overlay the signals directly on price—your choice.

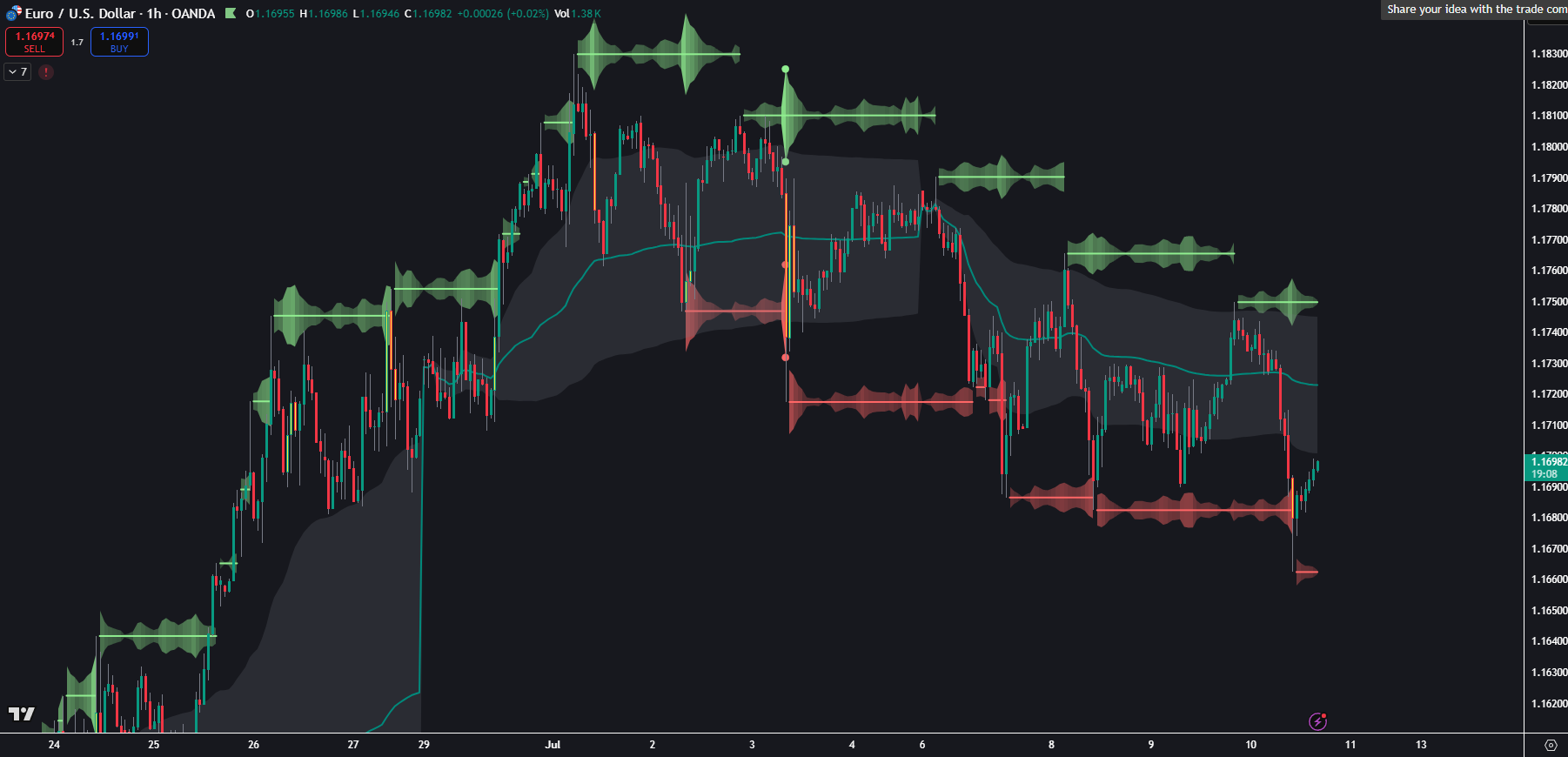

PrimePoint Traders Volume Weighted Support/Resistance

Discover the true battlegrounds of price action with our Volume-Weighted S/R indicator—now in a fully annotated, step-by-step edition for maximum clarity and control.

🔍 Key Features

Volume-Normalized Levels

Scans your chosen look-back window (default 25 bars) for the highest and second-highest volume bars.

Plots the high of the top volume bar as your Resistance and the low of the runner-up as your Support, so you see where genuine liquidity clusters.

ATR-Scaled Zones

Uses a long-period ATR (200 bars) to calculate a dynamic “padding” around each S/R level, then scales that padding by your bar’s relative volume percentile.

Creates gradient-filled bands that visually expand on heavy volume days—making key breakout and rejection zones impossible to miss.

Volume Spike Markers

Automatically drops tiny circles at the edges of your S/R zones when a bar’s volume exceeds your customizable threshold (default 80%), highlighting the most critical liquidity inflection points.

Bar Highlighting

Colors entire candles when their volume surges above a adjustable level (default 50%), so you can instantly spot sessions where “real money” is driving price.

Premium Indicators

PrimePoint Traders Advanced Pivot Finder

Unlock high-probability reversal points with our advanced Pivot Finder—combining volume-weighted momentum exhaustion with multi-zone thresholds to pinpoint market pivots and signal shifts in real time.

🔍 Key Features

Volume-Weighted Momentum Exhaustion

A proprietary formula ({(2·close – low – high)/(high – low)} × volume) gauges each bar’s exhaustion level, so only high-participation extremes register as true pivot candidates.Dual Trendline Composite

Two parallel “strength” lines (fast & slow) smooth momentum via cumulative volume sums over 8-bar and 20-bar windows—filtering noise and confirming genuine pivot setups.Seven Pivot Zones

Clearly defined bands at 0, 20, 35, 50, 65, 80, and 100 mark zones from “Deep Pivot” to “Extreme Exhaustion.” Subtle gray fills between zones help you visually track when the market moves from healthy to overbought or oversold territory.Automated Pump/Drop Alerts

Get notified the instant your composite oscillator crosses below 20 (“Watch for Pump”) or above 80 (“Watch for Drop”), so you can prepare for major reversals or breakouts.Clean Overlay & Zero Repaint

Plotted as a single white line beneath your chart, this indicator uses only past data—no look-ahead bias—making it perfect for live alerting and backtesting.Fully Customizable Parameters

– Momentum Periods: Tweak the fast (8) and slow (20) look-back lengths to suit scalping, swing, or position trading.

– Threshold Levels: Adjust any of the seven zone boundaries to match your preferred sensitivity.

– Source: Apply toclose,ohlc4, or any custom price series.

PrimePoint Traders Volume Weighted Average Price

Anchor your trading decisions to institutional‐grade benchmarks with our Weekly VWAP indicator—complete with customizable standard-deviation envelopes for precise volatility context on a higher timeframe.

🔍 Key Features

True Weekly VWAP Centerline

Automatically resets at the start of each trading week, calculating a session-accurate Volume-Weighted Average Price that reflects where the “big money” is positioned over longer cycles.Optional StdDev Bands

Surround the weekly VWAP with up to three customizable bands (±1σ, ±2σ, ±3σ) to visualize normal fluctuation ranges, moderate breakouts, and extreme price excursions.Clean, No-Repaint Logic

Uses Pine v5’s built-inta.vwapwithtimeframe.change("W")—so your lines update only on closed weekly bars, eliminating look-ahead bias for reliable backtesting and real-time alerts.Flexible Inputs

– Source: Plot VWAP off typical price (HLC3), close, or any custom series.

– Offset: Shift the entire profile forward/back by a fixed bar count for alignment or strategy testing.

– Band Multipliers: Tune each deviation envelope to your preferred volatility sensitivity.Overlay-Ready

Draws directly on your main price chart—maintaining clear visibility of candles and price action while providing higher-timeframe trend structure.